|

|

| Listen to the summary via VoiceAssist |

|

|

|

|

|

|

|

| • |

The Goods and Services Tax(GST) tax regime is set to be rolled out across India from July 1, 2017 |

| • |

Reserve Bank of India (RBI) Governor, Mr.Urjit Patel said the soon-to-be implemented GST will not only create a national market, but will also broaden the tax base which in turn will lower the overall taxes in the long-term |

| • |

Asian Development Bank (ADB) said that the GST would create a single national market and spur Indian economic growth, but cautions that there could be transitional challenges |

| • |

India's foreign exchange reserves touched a record high of $381.96 bn as on June 16, compared with $381.16 bn in the previous week |

| • |

RBI widens the scope of its banking ombudsman platform by including issues regarding mis-selling of third-party products and grievances related to mobile banking and e-banking issues |

| • |

Finance minister said people may face some difficulty initially when GST is rolled out, but in the long run the new regime would help cut tax evasion and check price rise |

| • |

Indian industry borrowed $1.05 bn from overseas markets in May, compared with $1.32 bn in the same month last year |

| • |

Union Cabinet cleared the sale of government stake in Air India and five of its subsidiaries, but the final modalities, including the quantum of stake sale, will be decided by a group of ministers |

| • |

An RBI committee set up to clear stressed corporate loans to review six more accounts in the next few days with debt of Rs. 10,000 cr under the Scheme for Sustainable Structuring of Stressed Assets (S4A). |

| • |

RBI may soon come out with Rs. 200 currency notes |

| • |

Government spending rose 55% in April-May over the same period a year earlier |

| • |

Government notifies the GST tax rate for construction of real estate at 18% as against 12% announced earlier |

| • |

Government is planning to integrate the direct and indirect taxation systems for all indirect taxpayers by linking the GST number with the PAN. |

|

|

|

|

|

|

|

| • |

US Trade deficit shrank slightly to USD 65.9 bn in May, compared to previous month’s print of USD 67.1 bn |

| • |

China’s Manufacturing PMI continued to show expansion, advancing to 51.7 in May, vs. previous month’s print of 51.2. Non-manufacturing PMI too showed healthy growth, coming in at 54.9 vs. previous month’s print of 54.5. Current account balance declined slightly, coming in at USD 18.4 bn in Q1-FY 2017 vs. previous quarter’s print of USD 19.0 bn |

| • |

US new home sales increased 2.9% to a seasonally adjusted rate of 610,000 units in May; April's sales pace was also revised sharply higher to 593,000 units from 569,000 units |

| • |

IMF cuts growth forecasts for the US economy to 2.1% for both 2017 and 2018 |

| • |

China's industrial profits surged 16.7% in May from a year earlier, accelerating from 14% in April |

| • |

The Institute of International Finance said global debt levels have surged to a record $217 trillion, driven by a $3 trillion borrowing spree in the developing world |

| • |

The US economy expanded 1.4% in Q1-FY 2017 compared to 2.1% growth in Q4-FY 2016 |

| • |

33 out of 34 US banks pass the stress test conducted by the US Federal Reserve |

| • |

In Eurozone, manufacturing PMI increased to 57.3 in June against previous month’s mark of 56.3. However, services PMI declined to 54.7 from May’s mark of 56.3. |

|

|

|

|

|

|

|

| • |

Indian equities ended marginally higher on Thursday, benchmark indices snapped a six-session losing streak to rise as hopes that global economic growth was on track lifted equities across geographies |

| • |

Indian Equity gains were however, limited as uncertainty over the implications of the GST which is to be rolled out on July 1 continued to dent the sentiments |

| • |

Housing finance companies witnessed selling pressure owing to concerns over their profitability and valuations |

| • |

Banking stocks were among the prominent laggards on Nifty amid concerns that the RBI's call to increase provisioning for bad loans may hurt profitability of banks in the near term. |

|

|

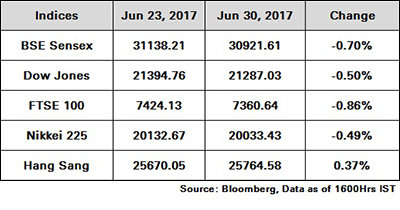

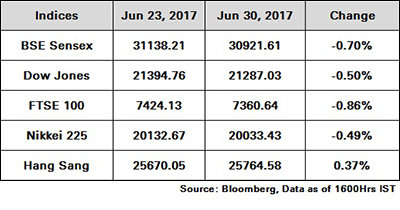

| During the week Sensex lost 0.70% to close at 30921.61 while Nifty declined 0.57% to close at 9520.90 |

|

|

|

|

|

|

| • |

The underlying sentiment remained upbeat on hopes of an interest rate cut by the RBI in the near term |

| • |

Trade remained subdued in the absence of fresh cues. The fall in treasuries globally has weighed on Indian gilts. However, strong demand for gilts by Public sector banks ahead of upcoming bond redemptions next quarter, supported prices |

| • |

State-owned banks’ profit sales towards the end of the quarter also weighed on prices |

| • |

Three reverse repo auctions were conducted by the central bank for a total notified Rs. 1,00,000 cr |

| • |

The slump in bonds globally (especially in US and Germany) weighed on Indian gilts. Further, profit booking by some investors, after the rally in the last few weeks, also dragged gilts down. However, the overall mood continues to remain positive as the outlook both on inflation and future rate trajectory looks benign |

| • |

RBI withdrew liquidity to the tune of Rs. 2.53 tn (net) under LAF (including fixed and variable rate repos and reverse repos), as of June 28. It injected Rs. 17.82 bn under Special Refinance Facility. |

|

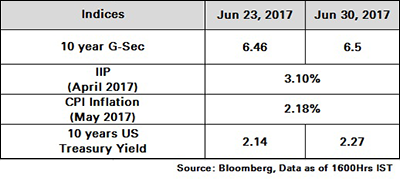

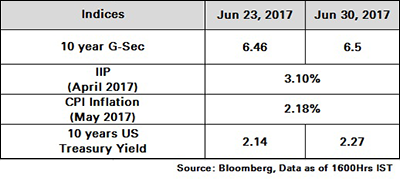

The 10Y benchmark yield ended at 6.50% vs. previous week’s close of 6.46%

|

|

|

|

|

|

|

|

| • |

US crude oil inventories rose by 0.1 mn barrels to 509.2 mn barrels for the week ended June 23 |

| • |

Oil prices declined post an increase in estimated US oil inventories according to API, which the analysts had expected to decline |

| • |

UAE energy minister signalled that there was no further talk of supply cuts by OPEC and its allies despite the slow drawdown in inventories. |

|

|

|

|

|

|

|

| • |

In absence of any major data coming in, gold prices have not showed much volatility |

| • |

Gold prices ended lower due to subdued demand from jewellers and stockists amid weak global trend |

| • |

Dollar index has remained weaker and that has helped the gold prices marginally |

| • |

Vote on US healthcare reforms was postponed and European Central Bank President,Mr.Mario Draghi pointed towards a trimming of monetary stimulus this year. The gains were capped however as Fed chief, Ms. Janet Yellen maintained her stand on another rate hike this year. |

|

|

|

|

|

|

|

|

| • |

A fall in domestic equities and state-owned banks’ demand for the dollar on behalf of oil importers also contributed to the rupee’s decline |

| • |

The rupee ended lower against the US dollar on Thursday on continued purchases of the greenback by state-owned banks and importers |

| • |

The Indian rupee ended weaker amidst persistent dollar buys by public sector banks. Further, month-end dollar demand from importers also weighed on the rupee. |

|

|

|

|

|

|

|

| |

| Sensex |

|

|

|

During the week Sensex lost 0.70% to close at 30921.61 while Nifty declined 0.57% to close at 9520.90.

|

|

|

|

| |

| Bond Yields |

|

|

|

The 10Y benchmark yield ended at 6.50% vs. previous week’s close of 6.46%.

|

|

|

|

|

|

|

|

Source: ICICI Bank Research, Bloomberg and CRISIL.

Disclaimer:

The information set out herein has been prepared by ICICI Bank in good

faith and from sources deemed reliable. ICICI Bank does not provide any

assurance as regards the accuracy of such information. ICICI Bank does

not accept any responsibility for any errors whether caused by

negligence or otherwise or for any direct or indirect loss / claim/

damage caused to any person, arising out of or in relation to the use of

information communicated herein.

If you do not wish to receive further marketing e-mails, to unsubscribe,click here. |

|