|

|

| Listen to the summary via VoiceAssist |

|

|

|

|

|

|

|

| • |

LokSabha passes the Companies Act (Amendment) Bill, 2016 that seeks to make significant changes to the 2013 law to remove complexities and improve ease of doing business, strengthen corporate governance standards and prescribes strict action against defaulting companies |

| • |

Government seeks Parliament's approval for supplementary grants worth Rs. 11,166.18 cr for the current financial year |

| • |

NITI Aayog CEO, Mr. Amitabh Kant said the government needs to exit infrastructure projects and even look at handing over jails, schools and colleges to the private sector as happens to be the case in countries like Canada and Australia |

| • |

A joint study conducted by FICCI and EY stated that there is an urgent need to address and seek resolution for the multiple factors dampening the interest of the private sector in terms of making investments in the transport sector |

| • |

International Monetary Fund (IMF) retained India's economic growth projections at 7.2% in 2017-18, up slightly from 7.1% in the previous year, adding that growth would accelerate to 7.7% in 2018-19 |

| • |

FDI inflows into India rose 23% to $10.02 bn in April-May of the current fiscal from a year ago |

| • |

India's forex reserves rose by $2.68 bn to $389.06 bn for the week ended July 14 |

| • |

Finance Minister, Mr. Arun Jaitley introduced a Bill in the LokSabha that would pave the way for the repeal of the State Bank of India (Subsidiary Banks) Act, 1959 and the State Bank of Hyderabad Act, 1956 |

| • |

NITI Aayog in its appraisal of the 12th Five Year Plan (2012-17) said that when measured at factor cost, the real GDP growth under the old methodology turns out to be 4.5% in 2012-13 and 4.7% in 2013-14, which is worse than the 'policy logjam' scenario. |

|

|

|

|

|

|

|

| • |

US goods trade deficit fell 3.7% to $63.9 bn in June from $66.4 bn in May |

| • |

US durable goods climbed 6.5% in June, orders for durable goods in May fell 0.1% |

| • |

China's profits of major industrial firms rose 19.1% year on year in June, up on May's 16.7% |

| • |

Japan's core consumer prices rose 0.4% in June from a year earlier, unchanged from the previous month |

| • |

US Federal Reserve kept the interest rate unchanged and said it expected to start winding down its massive holdings of bonds "relatively soon" in a sign of confidence in the US economy |

| • |

US existing home sales dropped 1.8% to a seasonally adjusted annual rate of 5.52 mn units in June; May's sales pace was unrevised at 5.62 mn units. |

|

|

|

|

|

|

|

| • |

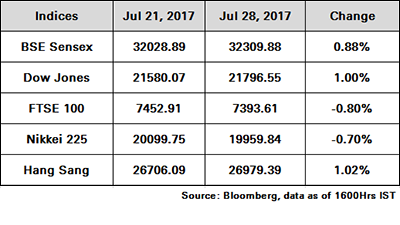

Benchmark indices touched fresh lifetime highs, with nifty closing above the 10k mark. A rally in commodity prices aided the Nifty metal index to close at its highest level in more than 3 years |

| • |

Sentiments were also supported by strong rally in international equities |

| • |

Earnings reports of Q1 – FY2018 of some major companies came below market expectations, dragging down the indices. Banks’ shares were one of the key drivers of the rally as markets pinned their hopes on revival in loan growth |

| • |

Indian benchmark indices ended flat on Thursday amid high volatility due to July F&O expiry. |

|

|

| During the week Sensex gained 0.88% to close at 32309.88 while Nifty inclined 0.99% to close at 10014.5 |

|

|

|

|

|

|

| • |

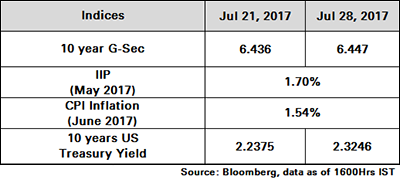

Government bond prices ended off earlier highs on Thursday as market players trimmed positions ahead of the weekly domestic gilt auction |

| • |

Bond prices strengthened tracking a fall in US benchmark treasury yields after the US Federal Reserve left the federal funds target range unchanged at 1.00-1.25% and said it expected to start the normalisation of its balance sheet relatively soon |

| • |

Expectations of a cut in interest rates at the Reserve Bank of India's policy statement next week limited the fall in prices |

| • |

A decline in US benchmark treasury yields and global crude oil prices lent support to prices intraday during the week |

| • |

Prices were put under pressure after some media reports indicated that government may not be adhering to its fiscal consolidation plan. However, bonds recouped losses after fresh reports intraday said the Centre will largely be sticking to the fiscal roadmap |

| • |

RBI withdrew liquidity to the tune of Rs. 2.6 tn (net) under LAF (including fixed and variable rate repos and reverse repos), as of July 25. It injected Rs. 2.55 bn and Rs. 15.08 bn under Marginal standing facility and Special Refinance Facility respectively. |

|

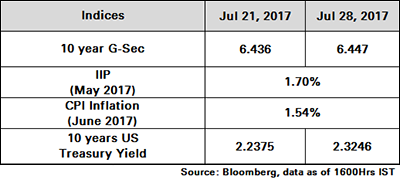

The 10Y benchmark yield ended at 6.45% vs. previous week’s close of 6.44%

|

|

|

|

|

|

|

|

| • |

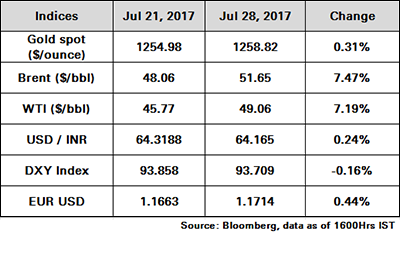

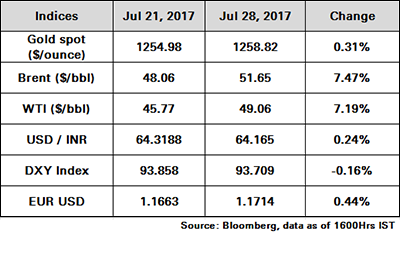

Crude oil prices for September delivery fell $1.15 to settle at $45.77 a barrel on the NYMEX on expectations for a rise in OPEC output |

| • |

During the week oil climbed to an eight week high as market confidence was boosted by EIA inventory figures falling by 7.2 million barrels last week, shrinking the stockpiles to the lowest since the start of the year. The rally was supported as favourable demand was witnessed during the summer driving season |

| • |

Crude rallied after talks between OPEC and non-OPEC producers ignited confidence of better compliance (Saudi Arabia and Nigeria in particular) amongst the members to curb output. However, scepticism on oil lingers as inventories remain above the five-year average |

| • |

The nations gathering in Russia resulted in little change over the wider supply agreement maintained earlier. However, the meeting did bring some relief after Saudi Arabia, the largest OPEC producer promised to cut its exports to 6.6 million from next month. The Baker Hughes data released for last week reflected the bearish stance on oil as the US rig count reduced by 1 to 764. |

|

|

|

|

|

|

|

| • |

Gold and the greenback traded back their positions as the announcement by Fed followed suit with market expectations and kept rates unchanged. The monetary stance lifted the metal to a 6 week high just as the dollar plummeted back to 13 month lows |

| • |

The yellow metal hovered around its highest level in a month as uncertainty looming around the efficacy of the Trump administration pushed the dollar to its lowest in over a year. |

|

|

|

|

|

|

|

|

| • |

FOMC statement, which was dovish on inflation, weighed heavily on the dollar index, aiding other currencies. Heavy dollar purchases by public sector banks capped gains |

| • |

The Fed's statement indicated that policy makers had become more concerned about a recent slowdown in US inflation |

| • |

The positive performance of equity markets, after significant flows from FPI’s had aided the rupee. However, month end dollar demand from importers capped further gains |

| • |

Reduction in the risk appetite globally, following turmoil in US political administration has weighed on emerging market currencies |

| • |

State-owned banks’ intraday dollar demand kept the rupee from strengthening further |

| • |

The rupee had risen against the US dollar tracking global dollar weakness on reports that US Special Counsel, Mr. Robert Mueller is expanding his investigation and looking into the business dealings of US President,Mr.Donald Trump. |

|

|

|

|

|

|

|

| |

| Sensex |

|

|

|

During the week Sensex gained 0.88% to close at 32309.88 while Nifty inclined 0.99% to close at 10014.5

|

|

|

|

| |

| Bond Yields |

|

|

|

The 10Y benchmark yield ended at 6.45% vs. previous week’s close of 6.44%

|

|

|

|

|

|

|

|

Source: ICICI Bank Research, Bloomberg and CRISIL.

Disclaimer:

The information set out herein has been prepared by ICICI Bank in good

faith and from sources deemed reliable. ICICI Bank does not provide any

assurance as regards the accuracy of such information. ICICI Bank does

not accept any responsibility for any errors whether caused by

negligence or otherwise or for any direct or indirect loss / claim/

damage caused to any person, arising out of or in relation to the use of

information communicated herein.

If you do not wish to receive further marketing e-mails, to unsubscribe,click here. |