|

|

| Listen to the summary via VoiceAssist |

|

|

|

|

|

|

|

| • |

Government says GST will not lead to inflation and rather make domestic goods competitive via-a-vis imported items |

| • |

Finance Minister, Mr. Arun Jaitley asserts that the government was giving top priority to addressing the issue of bad loans while acknowledging that the problem of non-performing assets was "adversely impacting" the Indian banking system |

| • |

NITI Aayog recommends a review of the tax exemption on agriculture income; also advises simultaneous elections for Parliament and all State Assemblies, starting 2024 |

| • |

The latest Monetary Policy Committee's meeting minutes show that the group is moving more towards an interest rate increase in the next few quarters though not in the near future as threat of inflation shooting past target looms. |

|

|

| Other important developments during the week were: |

| • |

Central government and cash-rich coal, power and oil public sector companies to jointly invest over Rs. 50000 crore to revive closed fertiliser plants and set up new gas pipelines, in a move aimed at making India self-sufficient in urea by 2020-21 and negating the need for imports |

| • |

National Pharmaceutical Pricing Authority (NPPA) fixes ceiling prices of 15 more drugs |

| • |

Government may impose customs duty on imported mobile phones after switching to the Goods and Services Tax (GST) regime as it seeks to give a boost to local manufacturing |

| • |

RBI Governor, Mr. Urjit Patel says the Indian banking system could be better off if some public sector banks are consolidated to have fewer but healthier entities, as it would help in dealing with the problem of stressed assets. |

|

| |

|

|

|

|

|

|

| • |

Mr. Emmanuel Macron won the first round of the French presidential election held earlier this week, while Ms. Marine Le Pen is in second place. The duo will be facing off in the second round due May 7 |

| • |

Bank of England policy maker, Mr. Michael Saunders said that a weaker pound would boost near-term inflation more than the official projection in February. He added that the current policy stance remains accommodative and that any increase in interest rates probably would be limited and gradual |

| • |

Federal Reserve staff have estimated that the shrinking of the Fed balance sheet would push the 10-year yield up by 75 basis points. They have assumed that Fed would take the balance sheet down to USD 2.3 trillion level from the current USD 4.5 trillion in course of five years |

| • |

BOJ officials have signaled that they will avoid any moves that suggest an early rate increase. They are worried that the expectations of an early rate increase might strengthen yen and hurt Japan’s exports |

| • |

US Treasury Secretary, Mr. Steven Mnuchin and National Economic Council Director, Mr. Gary Cohn unveiled the “broad principles” of President Donald Trump’s tax reform plan last night |

| • |

The plan, which was sparse on the details, proposed cutting the corporate tax rate to 15%, a one-time repatriation tax for offshore profits and a move to a territorial tax system |

| • |

Mostly in keeping with expectations, the ECB decided to continue its asset purchases at the rate of EUR 60 billion per month from April 2017 to December2017.The rate on the main refinancing operations has been kept unchanged at 0%,the rate on marginal lending facility at 0.25% and the rate on the deposit facilityremains at -0.4%. |

|

|

|

|

|

|

|

| • |

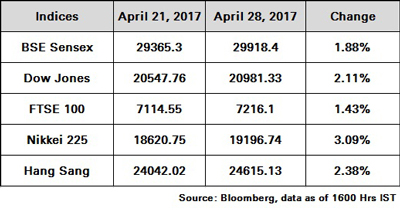

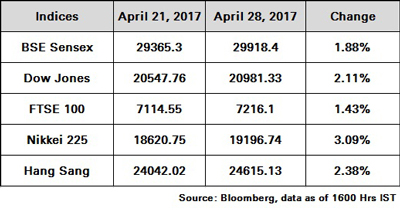

Sentiments remained positive across the globe as investors cheered after market-favoured candidate,Mr. Emmanuel Macron won the first round of the French presidential election |

| • |

Markets across the globe also rallied ahead of the US President Donald Trump's big tax cut announcement |

| • |

Domestic benchmark indices rose to their lifetime highs before ending at record closing levels tracking global markets and as sentiment remained upbeat on robust Q4 FY2017 earning. The Nifty rose to a lifetime high of 9367.00 points |

| • |

Receding geopolitical tensions, along with positive earnings reports have fuelled the current rally |

| • |

Sentiments were also boosted as rupee strengthened against the dollar |

| • |

Government lines up offer-for-sales in seven public sector undertakings including Indian Oil Corporation, NTPC and SAIL. |

|

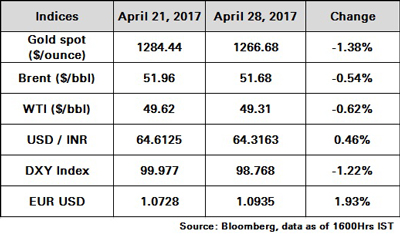

During the week Sensex advanced 1.88% to close at 29918.40 while Nifty gained 1.98% to close at 9304.05

|

|

|

|

|

|

|

|

| • |

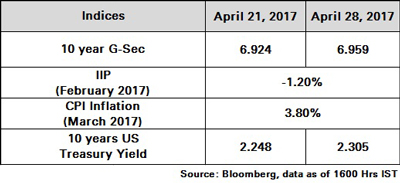

The underlying sentiment for bonds remained weak despite the domestic gilt sale being fully subscribed |

| • |

The underlying sentiment for debt remained weak as minutes of the RBI Monetary Policy Committee’s April meeting sparked interest rate hike fears |

| • |

According to the minutes, the RBI’s monetary policy committee cited upside risks to inflation arising from price pressure excluding food and fuel as the main reason for keeping its policy rate unchanged. |

|

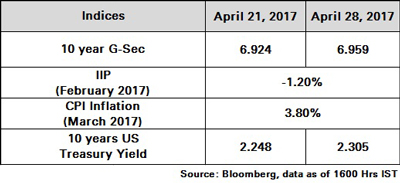

The 10Y benchmark yield ended at 6.96% vs. previous week’s close of 6.92%

|

|

|

|

|

|

|

|

| • |

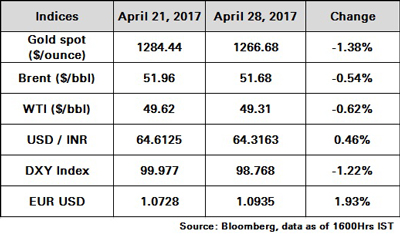

While OPEC production cut failed to bring the oil market to balance, investors are pinning their hopes on improving demand due to seasonal factors along with surging refinery maintenance to dent the continuously rising inventory levels |

| • |

Outcome of Russian Energy Minister, Mr. Alexander Novak’s meet with the Russia’s oil companies this week to discuss the possible extension of supply cuts with OPEC will be closely tracked |

| • |

EIA data showed that gasoline along with other distillates inventories showed a huge build |

| • |

Going forward, a surging demand due to upcoming summer driving season, along with an extension of an OPEC production cut seems to be the only events which could lift the market sentiment. |

|

|

|

|

|

|

|

| • |

News of North Korea conducting a live-fire exercise just as a US submarine docked in South Korea is keeping the markets on the hook. Volatility of the yellow metal gets a further boost as investors ponder over the possibility of a US government shutdown on April 29 if the Congress does not approve spending bill. Policy decisions by ECB and BOJ will be keenly tracked |

| • |

The gains were capped by a strengthening USD in anticipation of the tax cut announcement by the Trump administration. Increasing risk appetite, with global equities scaling record highs, is weighing on the yellow metal. |

|

|

|

|

|

|

|

|

| • |

The strength in the INR has been contributed by a confluence of domestic as well as external factor |

| • |

In a recent comment, the US President raised concern regarding the strength in the US Dollar, triggering its broad-based weakness. The lack of clarity in US economic reform policy and not so hawkish policy stance by the Federal Reserve weighed on the currency. Expectation of monetary policy normalisation by the other central bank’s such as the ECB too weighed on the dollar trajectory |

| • |

Expectation of a strong reform push by the government, credible budget and reasonably low crude prices led to strong capital flows into the economy. Recovery in economic activity post demonetisation has also aided the sentiment. On the policy front, the passage of the GST bill in the budget session has further boosted the confidence |

| • |

India’s external sector outlook continues to remain favourable: India’s external sector outlook has improved and the vulnerability has reduced considerably amid balance of payment surplus and strong FDI flows vis-à-vis the current account deficit. Besides the strong FDI flows, portfolio inflows too have turned strong during the last few months |

| • |

RBI intervention strategy has failed to stem appreciation bias in the currency. Overwhelming capital flows as well as excess systematic liquidity might have played a role in limiting the impact of RBI’s FX intervention. In this regard, it should be noted that the net portfolio inflows amounted to USD 9.1billion in March, the highest monthly flows on record. |

|

|

|

|

|

|

|

| |

| Sensex |

|

|

|

During the week Sensex advanced 1.88% to close at 29918.40 while Nifty gained 1.98% to close at 9304.05

|

|

|

|

| |

| Bond Yields |

|

|

|

The 10Y benchmark yield ended at 6.96% vs. previous week’s close of 6.92%

|

|

|

|

|

|

|

|

Source: ICICI Bank Research, Bloomberg and CRISIL.

Disclaimer:

The information set out herein has been prepared by ICICI Bank in good

faith and from sources deemed reliable. ICICI Bank does not provide any

assurance as regards the accuracy of such information. ICICI Bank does

not accept any responsibility for any errors whether caused by

negligence or otherwise or for any direct or indirect loss / claim/

damage caused to any person, arising out of or in relation to the use of

information communicated herein.

If you do not wish to receive further marketing e-mails, to unsubscribe,click here. |