|

|

| Listen to the summary via VoiceAssist |

|

|

|

|

|

|

|

| • |

An Asian Development Bank (ADB) report said India is expected to achieve the projected growth rate of 7.4% in 2017 and further up 7.6% next year on strong consumer demand |

| • |

Unique Identification Authority of India (UIDAI) launches the mAadhaar app, a digital tool that allows holders of Aadhaar numbers to carry their Aadhaar card in their smartphones |

| • |

SEBI plans to cut the time taken for a security to list on an exchange from the date of closure of its IPO to three days |

| • |

SEBI asks Indian companies to temporarily stop issuing of rupee-denominated bonds till the total utilisation of corporate debt issuance limit by foreign entities falls below a certain threshold |

| • |

A World Bank report says Indian economy is expected to grow at 7.2% this financial year, up from 6.8% in 2016 |

| • |

NITI Aayog Vice Chairman, Mr.ArvindPanagariya says India's GDP could rise to about $8 trillion over the next 15 years, if the country registers an economic growth of 8% annually and come very close to eliminating abject poverty entirely |

| • |

SEBI asks banks to disclose to bourses bad loan divergences immediately, along with annual results, after they get communication over such difference from the RBI |

| • |

SEBI is planning to tighten Depository Receipts (DRs) regulations as part of efforts to check the flow of black money into the stock market |

| • |

The Goods and Services Tax (GST) Council increased the cess on cigarettes, in a bid to reduce profiteering by companies |

| • |

RBI comes out with fresh tender for currency security features, mandating that the supplier set up the manufacturing unit in India within two years and gradually increase the local content |

| • |

Inflation based on the Wholesale Price Index (WPI) slipped to a 14-month low of 0.90 % in June as food inflation remained negative; WPI stood at a five-month low of 2.17% in May |

| • |

India's exports grew 4.39% to $23.5 bn, while imports rose 19% to $36.5 bn, leaving a trade gap of about $12.9 bn in June, compared with $13.84 bn in May |

| • |

India's forex reserves fell $161.9 mn to $386.37 bn in the week to July 7 due to a fall in foreign currency assets. |

|

|

|

|

|

|

|

| • |

European Central Bank President, Mr. Mario Draghi kept key interest rate unchanged; said the bank needs persistence and patience in order to push inflation toward its goal of just under 2%; adds that the bank will keep buying 60 bn euros in bonds through year-end and longer if needed |

| • |

US housing starts jumped 8.3% to a seasonally adjusted annual rate of 1.22 mn units compared to May's sales pace of 1.12 mn units; US building permits increased 7.4% for June to an annualised rate of 1.25 mn from 1.17 mn in May |

| • |

Bank of Japan keeps its monetary policy unchanged, but cuts inflation forecasts; it now expects inflation to be at 1.1% for the current fiscal, down from its previous forecast of 1.4%, while for the next fiscal, it expects inflation to hit 1.8% instead of 1.9% |

| • |

UK consumer prices index came in at 2.6% in June, down from 2.9% in May, while producer price index rose 3.3% on the year to June from 3.6% in May |

| • |

The Chinese economy grew 6.9% in the second quarter from a year earlier, the same rate as the first quarter |

| • |

China's industrial output rose 7.6% in June from a year earlier, compared with 6.5% gain in May. |

|

|

|

|

|

|

|

| • |

Indian benchmark indices ended down on Thursday as gains made earlier were erased by losses in index heavyweights |

| • |

Banking stocks saw buying spree amid hopes of a rate cut by the RBI |

| • |

Pharmaceuticals stocks witnessed significant buying primarily led by Aurobindo, after the company received the USFDA's approval for the generic of Renvela, thereby raising hopes that it will likely trigger more approvals for complex generic filings by Indian companies |

| • |

Asian markets rallied on strong GDP and industrial output data from China – the world’s second largest economy |

| • |

IT counters were the biggest laggards on Nifty, weighed by disappointing results from sector majors - TCS and Infosys, falling 2% and 0.5%, respectively. |

|

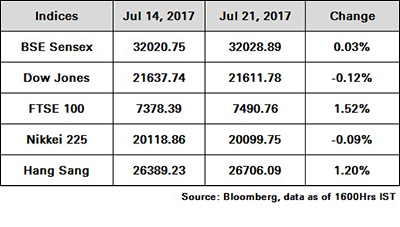

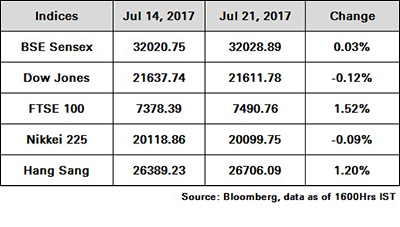

During the week Sensex gained 0.03% to close at 32028.89 while Nifty advanced 0.29% to close at 9915.25

|

|

|

|

|

|

|

|

| • |

Earlier in the session, bonds traded in a narrow range, as market players remained on the sidelines ahead of the central bank's open market bond sale |

| • |

RBI conducted its scheduled OMO of Rs. 100 bn, the results of which were favourable. After this OMO, the focus of the market now shifts to the upcoming monetary policy where the RBI is widely expected to deliver a rate cut |

| • |

The 10-year benchmark 6.79%, 2027 bond settled at 6.45% yield on Thursday, steady compared to Wednesday |

| • |

Heavy supply of gilts in the month has weighed on the gilts. However, the overall sentiment continues to remain positive on expectation of a rate cut by the RBI in its upcoming policy |

| • |

Prices remained range-bound through most of the session as market players avoided large purchases in the absence of fresh cues |

| • |

The central bank held three reverse repo auctions of 27-day, 14-day and 7-day durations for a total notified Rs. 40,000 cr. The apex bank also held a 14-day term repo auction for a notified Rs. 20,500 cr |

| • |

The underlying market sentiment remained positive as the latest domestic consumer inflation figures aided hopes of an interest rate cut by the RBI in its August policy review. |

|

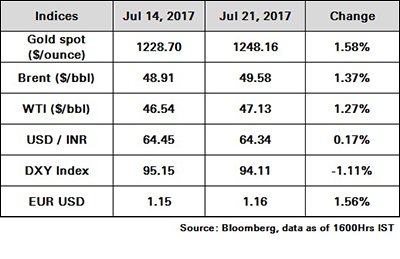

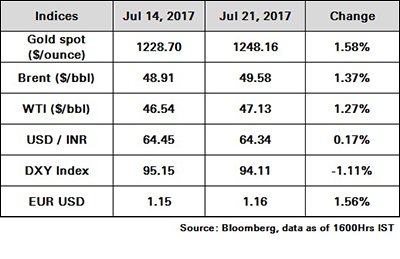

The 10Y benchmark yield ended at 6.43% as compared to previous week’s close of 6.46%.

|

|

|

|

|

|

|

|

| • |

A more than expected drawdown in crude inventories eased concerns over a global supply glut, pushing up oil prices. EIA data showed decline of 4.73 million barrels last week. The gains were however, capped as Kuwait planned to increase its light oil capacity by 200,000 barrels a day by December |

| • |

Crude oil prices rose 72 cents to settle at $47.12 a barrel on the NYMEX after US government data showed a decline in US crude stockpiles for a third week in a row |

| • |

US crude inventories fell by 4.7 mn barrels to 490.6 mn barrels for the week ended July 14 |

| • |

JODI data also gave mixed signals with Saudi Arabia crude shipments falling while that of Iraq rising in May as compared to April. |

|

|

|

|

|

|

|

| • |

The dollar strengthened globally following the Bank of Japan’s monetary policy announcement, thereby putting the rupee under pressure. |

| • |

The rupee ended higher against the US dollar sometime during the week due to global weakness in the greenback following the release of some weak US economic data last week |

| • |

The rupee was also supported by sales of dollars by foreign banks on behalf of foreign funds that invested in the domestic equities market. |

|

|

|

|

|

|

|

|

| |

| Sensex |

|

|

|

During the week Sensex gained 0.03% to close at 32028.89 while Nifty advanced 0.29% to close at 9915.25

|

|

|

|

| |

| Bond Yields |

|

|

|

The 10Y benchmark yield ended at 6.43% as compared to previous week’s close of 6.46%.

|

|

|

|

|

|

|

|

Source: ICICI Bank Research, Bloomberg and CRISIL.

Disclaimer:

The information set out herein has been prepared by ICICI Bank in good

faith and from sources deemed reliable. ICICI Bank does not provide any

assurance as regards the accuracy of such information. ICICI Bank does

not accept any responsibility for any errors whether caused by

negligence or otherwise or for any direct or indirect loss / claim/

damage caused to any person, arising out of or in relation to the use of

information communicated herein.

If you do not wish to receive further marketing e-mails, to unsubscribe,click here. |

|