|

|

| Listen to the summary via VoiceAssist |

|

|

|

|

|

|

|

|

|

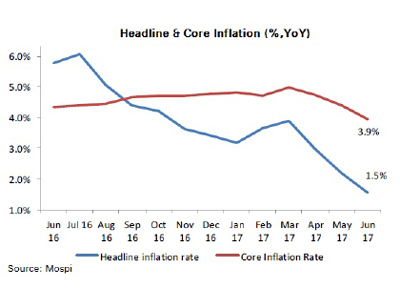

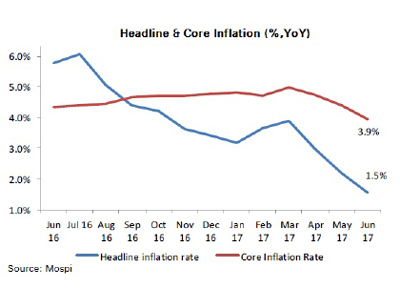

The softness in inflation persisted in June as well

|

| CPI fell to 1.54% YoY in June vs. 2.2% YoY in the previous month. Besides the contraction in food prices, we were surprised by the ~40 bps softening in core inflation during the month. |

| Within the food category, vegetables and protein prices contracted by 16.5%YoY and 2% YoY respectively. while cereal prices softened to 4.4%YoY (vs. 4.8% previously). Meanwhile the slowdown in core prices were broad based. All the major categories, such as housing, clothing and services witnessed a slowdown in prices. |

| Going forward, the HRA hikes are expected to be implemented from the month of July and our calculation indicates ~12 bps increase in housing inflation on a monthly basis starting July on account of this factor. On full implementation by Centre and States, annual impact is likely to be ~110 bps. Our baseline forecast for CPI inflation is 4.0% by March 2018 inflation and the outturn over the next few months is expected to remain below the 2% mark. |

| The RBI in its recent policy statement has lowered the range for inflation trajectory for FY2018 sharply to 2-3.5% for H1 and 3.5-4.5% YoY for H2. Against this backdrop. we expect RBI to deliver a 25 bps rate cut in the August policy meeting. We also believe that the argument in favour of further rate cuts have strengthened with the low inflation environment. |

|

|

|

|

Weakness in IIP continues; most categories witnessed slower growth

|

|

Headline IIP came in at 1.7% YoY as compared to 2.8% YoY earlier. The print was on expected lines and this is the third consecutive month of slowdown in industrial production.

|

| • |

On the sectoral side, mining and manufacturing both remained weak but electricity picked up pace. |

| • |

On the use-based front, the outcome was mixed and consumer durables, capital goods and infrastructure sectors posted very weak performances. On the other hand, consumer non-durables continues to remain on a robust footing. |

|

|

Significant positive contributions were made by diesel, electricity, two-wheelers etc. whereas substantial drag was seen from commercial vehicles, auto components etc.

|

|

While robust agricultural output supported by normal monsoons is likely to support consumer non-durables growth going ahead, consumer durables may continue to see headwinds. We had expected GST related slowdown in this sector. Moreover, the first quarter of FY2018 is likely to have witnessed substantial de stocking of inventory and the weakness in IIP is likely to continue for a couple of months on account of possible GST related implementation considerations. Moreover, data does not seem to indicate any incipient trend of an investment recovery.

|

|

|

|

|

|

|

|

|

|

US: Robust job additions in conjunction with improvement in wage growth

|

| • |

US non-farm payrolls. (NFP) added a higher-than-expected 222K jobs in June vs. a (revised) print of 152K in May |

| • |

Unemployment rate rose mildly to 4.4% in June from a 16-year low 4.3% May. |

| • |

Wage growth rose to 2.5% YoY in June, in an encouraging development for the Fed’s trajectory. |

|

|

|

Other important developments for the week:

|

| • |

The G20 communique released reflected the isolation of the US on the key climate impact issue. The communique reinforced the commitment of the other 19 nations to the Paris Climate Accord. while the US simply promised to enable other members to use fossil fuels cleanly and efficiently. |

| • |

In her semi-annual testimony to the Congress, Federal Reserve Chair. Ms. Janet Yellen sounded cautious on the inflation outlook. She said that though the US economy is healthy enough for Fed to raise rates, a low inflation rate and low neutral rate may leave the central bank with diminished leeway. She added that the balance sheet reduction program would take place “this year”. She mentioned an expected rebound in growth in Q2 - FY 2017 on the back of healthy consumption and investment. She also said that a rise in asset prices has not been accompanied by a “substantial increase in borrowing”. |

| • |

Ms. Janet Yellen also said that 3% economic growth in the US was difficult to achieve in the next few years, casting doubts over the Trump administration’s ability to reach it. She added that labour expansion would remain difficult due to ageing population and productivity gains would also be a challenge. |

| • |

Fitch affirmed China at A+ and maintained a stable rating. Positives included favourable short-term growth prospects and strength of external finances, while on the minus side Fitch recognised large and rising debt levels in China's non-financial sector. The rating agency expects growth in China to average 6.5% YoY this year. |

| • |

US President. Mr. Donald Trump said that he is considering imposing quotas and tariffs to deal with steel dumping from China and other countries. |

|

|

|

|

|

|

|

|

|

|

|

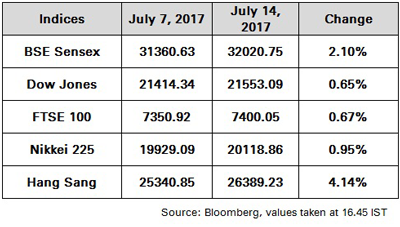

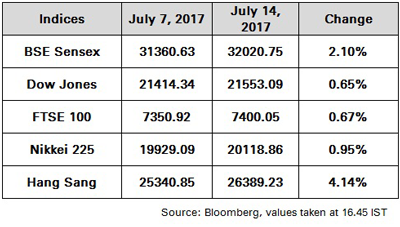

Indian equities started this week with scaling newer highs multiple times during the week. The National Stock Exchange was closed for trading most of the Monday morning hours due to technical glitches. Though trading resumed post noon, volumes were much below the daily average due to no proper update of prices for most of the afternoon trading. The positive performance of equity markets comes as the domestic earnings season commences.

|

|

While expectations from the earnings season remains quite muted, any positive surprises from the earnings reports will aid the already bullish markets. Firm global markets and hopes of an interest rate cut kept sentiment buoyant. Breaching the 32,000-points mark for the first time ever, the Sensex recorded a lifetime high of 32,091.52 points, while Nifty was a touch away from topping the 9,900-points mark, as it hit a lifetime high of 9,897.25 points.

|

| During the week Sensex gained 2.10% to close at 32020.75 while Nifty advanced 2.23% to close at 9886.35

|

|

|

|

|

|

|

|

|

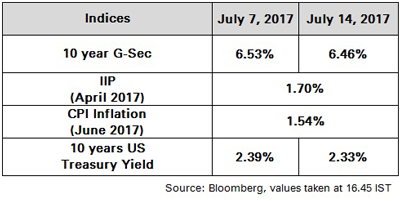

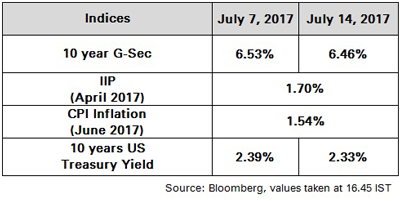

| Indian government bonds started week much higher. Gilts saw renewed demand ahead of the CPI inflation print. However, RBI’s announcement of an INR 100 bn OMO on Friday and some profit hooking weighed on gilts capping further rise. |

| Gilts witnessed strong demand from FPI’s which aided prices. A sharp decline in core and headline CPI in June supported bonds. |

| The 10Y benchmark yield ended at 6.46% as compared to previous week’s close of 6.53%.

|

|

|

|

|

|

|

|

|

|

|

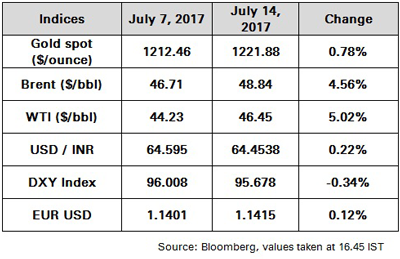

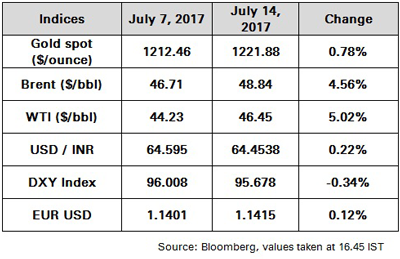

Oil fell by ~1% on Monday. The decline came on the back of a rise in US oil rigs. The count has reached 763, the highest since April 2015 according to Baker Hughes report. However, on Sunday Kuwait said that Libya and Nigeria can be asked to curtail their production even before the official OPEC meet up in November. These OPEC countries had been exempted from production cut deal. But Libya said that its humanitarian and economic situation should be taken into account before any such decision. Turkish PM also advised Cyprus not to take unilateral action in all areas including oil and gas. Continued production from US and deal exempt OPEC countries weighed against oil prices.

To maintain credibility of the OPEC production cut deal, Russian energy minister Mr. Alexander Novak also reiterated that the output cut is working. However, the momentum could not be sustained as in a broader context oil supply still remains high.

Oil prices increased by ~1.35% basis API report released on Tuesday, which showed a decline in US crude oil inventories by 8.13 million barrels last week.

The Organisation of Petroleum Exporting Countries claimed that the world requires only 32.2 million barrels per day (bpd) of its crude next year, down 60,000 bpd from this year and about 400,000 bpd less than it pumped in June. The demand stance was also heightened post data depicted that China imported 8.55 million bpd in the first six months of the year, up 13.8% on the same period in 2016, making it the world's biggest crude importer ahead of the United States.

|

|

|

|

|

|

|

|

Gold started this week on a lower note. Hints from central bank officials of advanced economies on tightening of monetary policy weighed against gold. A stronger USD also pulled down gold prices.

Gold rallied on Wednesday amid controversial political news from the US. Gold prices gained as uncertainty over the Trump administration rose.The rally in equities markets limited the upside in gold prices.

|

|

|

|

|

|

|

|

Rupee to remain supported on robust flows

Indian Rupee started this week stronger. Dollar sales by foreign banks for inflows into equities and bonds aided the domestic currency. However, Dollar purchases by PSU and state owned banks weighed on the Rupee. Traders remained on the side-lines ahead of domestic inflation prints, as well as Fed Chair MS. Janet Yellen’s testimony during first half of the week.

The Rupee sustained gains as few foreign banks sold Dollars in lackluster trade. Global Dollar weakness and positive local equities supported the domestic currency.

|

|

|

|

|

|

|

|

| |

| Sensex |

|

|

|

|

During the week Sensex gained 2.10% to close at 32020.75 while Nifty advanced 2.23% to close at 9886.35

|

|

|

|

| |

| Bond Yields |

|

|

|

|

The 10Y benchmark yield ended at 6.46% as compared to previous week’s close of 6.53%.

|

|

|

|

|

|

|

|

Source: ICICI Bank Research, Bloomberg and CRISIL.

Disclaimer:

The information set out herein has been prepared by ICICI Bank in good

faith and from sources deemed reliable. ICICI Bank does not provide any

assurance as regards the accuracy of such information. ICICI Bank does

not accept any responsibility for any errors whether caused by

negligence or otherwise or for any direct or indirect loss / claim/

damage caused to any person, arising out of or in relation to the use of

information communicated herein.

If you do not wish to receive further marketing e-mails, to unsubscribe,click here. |

|