|

|

| Listen to the summary via VoiceAssist |

|

|

|

|

|

|

|

| Consumer and Capital Goods, re - enter negative category |

| • |

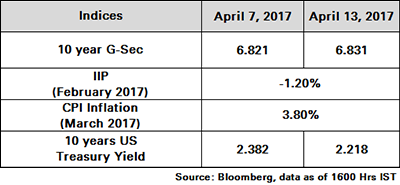

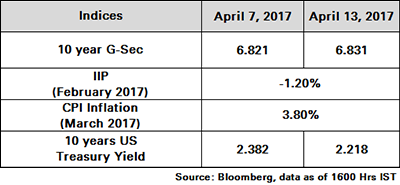

Headline IIP declined by 1.2% YoY in February as against +3.3% YoY growth previously. |

| • |

The February IIP came in at a four-month low -1.2% YoY as compared to +3.3% YoY in the previous month. On a sequential basis, the metric contracted 5.2% as compared to the 4.5% MoM growth seen in January. |

| • |

On the sectoral side, growth decelerated for all sectors. While mining (3.3% vs. 5.3%) and electricity (0.3% vs. 3.9%) sectors slowed sharply in yearly terms, manufacturing sector saw a 2.0% YoY contraction vs. +2.9% YoY in January. Industry groups such as sugar, cement, plastic machinery, and aluminium conductors contributed to the headline de-growth. |

| • |

On the use-based classification, all categories barring intermediate goods showed slower growth. Growth was arrested for capital goods (- 3.4% vs. +10.9%) and consumer durables (-5.6% vs. +0.5). |

| • |

In line with expectations, CPI inflation edged up to 3.81% YoY in February from 3.65% YoY previously. |

| • |

Food inflation continued to rise and cereals printed 5.38% YoY as against 5.3% YoY earlier.A significant development was the increase in core inflation after posting a decline last month. |

|

|

| Other important developments during the week were: |

| • |

The Securities and Exchange Board of India (SEBI) plans to make it mandatory for companies raising less than ₹5bn through IPO to appoint a monitoring agency to keep track of the use of funds. |

| • |

The board also plans to reduce paperwork for foreign portfolio investors wanting to bring money into the country and allow systemically important NonBanking FinancialCompanies (NBFCs) in the institutional category in public issues. These proposals are likely to be discussed at the SEBI board meeting on April 26, 2017. |

| • |

Petrol and diesel prices in some cities will be revised daily in sync with international rates, according to two officials from oil marketing companies. This will be effective May 1, 2017 in five cities including Puducherry, Visakhapatnam, Udaipur, Jamshedpur and Chandigarh as part of a pilot project. This will be extended to other parts of the country after an assessment of consumer response. |

| • |

The Supreme Court said power companies couldn’t raise pre-set tariffs if fuel becomes costlier due to changes in laws overseas, setting aside rulings by regulators and dealing a blow to Tata Power and Adani Power. The court asked the electricity regulator to consider the matter afresh keeping in mind the government's revised coal allotment and power tariff guidelines. |

|

| |

|

|

|

|

|

|

| • |

US President, Mr. Donald Trump ventured into monetary policy, expressing his preference for a weaker Dollar. He also added that he would like the interest rates to be low to support it. |

| • |

Federal Reserve Chair, Ms. Janet Yellen has said that the focus of the monetary policy has shifted from stimulating the economy to sustaining growth. She emphasised that the Fed does not want to be in a position where they have to raise rates rapidly, causing a recession in the economy. |

| • |

European Central Bank President, Mr. Mario Draghi has said that he remains confident of the economic recovery that is underway in euro area. He maintained that monetary policy would remain supportive to make sure that the recovery continues. |

| • |

Bank of England's, Mr. McCafferty has said that the only path to interest rate hikes would be a strengthening economy. His recent remarks are seen as a sign of moderation from his earlier hawkish stance. |

|

|

|

|

|

|

|

| • |

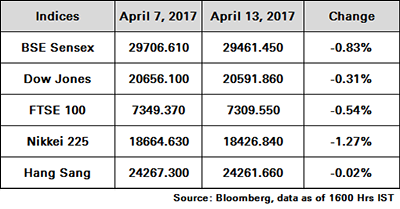

Equities were volatile for the week, mirroring the trend in Asian markets, and as investors are likely to maintain caution ahead of corporate earnings announcements. |

| • |

Release of weak key economic data and persisting geopolitical concerns following the US' missile strike on Syria added to the uncertainty. |

| • |

Bias for domestic equities, however, remains positive as foreign as well as domestic investors continue to invest in Indian markets on expectations of an earnings recovery in the new fiscal year. |

|

During the week Sensex lost 0.83% to close at 29461.45 while Nifty declined 0.52% to close at 9150.8

|

|

|

|

|

|

|

|

| • |

The likelihood of the RBI draining surplus liquidity from the banking system weighed on sentiment. |

| • |

Debt market sentiment remained weak after the RBI's policy statement last week, with most players expecting the central bank to soon detail measures to rein in surplus liquidity in the banking system. |

| • |

During the week, RBI withdrew liquidity to the tune of INR 4.5 tn (net) under LAF (including fixed and variable rate repos and reverse repos), as of April 10, 2017. It injected INR 12.12 bn under Special Refinance Facility. |

| • |

Indian bond prices were however sharply higher on Thursday morning. The yields are lower today as the Consumer Price Index-based inflation reading was lower than expected along with support from declining US Treasury yields, which fell sharply on Wednesday. |

| • |

However, the gains would be capped by caution exercised by traders who may remain on sidelines before INR 180bn gilts auction. |

|

The 10Y benchmark yield ended at 6.83% vs. previous week’s close of 6.82%

|

|

|

|

|

|

|

|

| • |

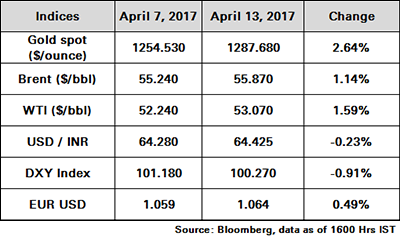

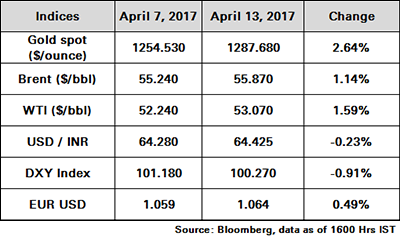

Oil is, continuing its fall from the peak reached on Tuesday for the second day. |

| • |

While the estimates released by Energy Information Administration showed that the overall inventories declined, markets have rather concentrated on the stockpile data at Oklahoma crude hub, which rose by 276,000 barrels in the week. |

| • |

OPEC has raised its forecast for supplies from non-member countries in 2017 anticipating increase in supply from US shale drillers has weighed in on the prices. |

| • |

Russian Energy Minister, Mr. Alexander Novak has said that his country's output cuts would reach 250,000 barrels per day by mid-April. |

|

|

|

|

|

|

|

| • |

Gold is sustaining its recent high levels. Heightened tensions in the Korean peninsula and Middle East are driving the current rally despite rising expectations of rate hike from the Federal Reserve. |

| • |

US President, Mr. Donald Trump’s preference for a weaker Dollar and lower interest rates have supported the gold prices. |

| • |

Safe haven demand due to geopolitical risks arising from North Korea and outcome of French elections are expected to support gold prices. |

| • |

The demand for the yellow metal surged after North Korean media reported that it would not hesitate to use nuclear weapons against US. On the EU front, rising poll numbers for the far left candidate Mr. Jean-Luc Melenchon spooked investor sentiment as French elections approach in two weeks. |

|

|

|

|

|

|

|

|

| • |

US President, Mr. Donald Trump’s comments on the currency has weakened Dollar against all the major currencies and the Indian Rupee. However, equity performance is expected to weigh in on further movements. |

| • |

Gains on the Rupee was capped during the week, as importers, especially those of oil, are expected to purchase the greenback. |

| • |

State-owned banks may also step up their purchases of the Dollar to meet the Government's demand for interest payments and defence-related payments. |

| • |

Caution due to geopolitical risks may also weigh on the Rupee. |

|

|

|

|

|

|

|

| |

| Sensex |

|

|

|

During the week Sensex lost 0.83% to close at 29461.45 while Nifty declined 0.52% to close at 9150.8

|

|

|

|

| |

| Bond Yields |

|

|

|

The 10Y benchmark yield ended at 6.83% vs. previous week’s close of 6.82%

|

|

|

|

|

|

|

|

Source: ICICI Bank Research, Bloomberg and CRISIL.

Disclaimer:

The information set out herein has been prepared by ICICI Bank in good

faith and from sources deemed reliable. ICICI Bank does not provide any

assurance as regards the accuracy of such information. ICICI Bank does

not accept any responsibility for any errors whether caused by

negligence or otherwise or for any direct or indirect loss / claim/

damage caused to any person, arising out of or in relation to the use of

information communicated herein.

If you do not wish to receive further marketing e-mails, to unsubscribe,click here. |

|