|

|

| Listen to the summary via VoiceAssist |

|

|

|

|

|

|

|

| The Goods and Services Tax (GST) Council in its 20th meeting decided to cut the tax rate for job work for the entire value chain of textiles sector to 5% (earlier, the GST for job works related to manmade fibres was 18%), along with reduction in rate for tractor parts to 18% from 28%. Also, the Council gave in-principle approval to the e-way bill rules, likely to come into force from October 1. The Council will meet next on September 9, where it will take up the issue of many rice millers deregistering their brands to escape taxation under the GST. |

| The Government tabled the Medium Term Expenditure Framework in Parliament. While fiscal deficit isexpected to stand at 3.0% of GDP in FY2019, capital expenditure as a percentage of total expenditure is expected to increase to 20% in FY2020. |

|

|

|

|

|

|

| US: Jobs addition beats expectations; wage growth steady |

| • |

US Non-Farm Payrolls (NFP) added a higher-than-expected 209K jobs in July vs. a (revised) print of 231K in June |

| • |

Wage growth remained steady at 2.5% YoY in July, and is a welcome development amid several soft price prints |

| • |

The Fed should remain on its tightening trajectory after markets adjust to balance sheet tapering. |

|

|

| Other important developments during the week: |

| • |

North Korea said on Wednesday that it is considering plans for a missile strike on the US Pacific territory of Guam, just hours after President, Mr. Donald Trump warned that any threat to the United States would be met with "fire and fury" |

| • |

US President, Mr. Trump issued new warnings to North Korea by saying his earlier comments were not “tough enough”. He added that any attack by North Korea on US or its allies would force him to do things which “they never thought possible” |

| • |

In line with market expectations, Reserve Bank of New Zealand left its official cash rate unchanged at 1.75% on Thursday. Bank governor, Mr. Graeme Wheeler said that the monetary policy will remain accommodative for a considerable period. |

|

| |

|

|

|

|

|

|

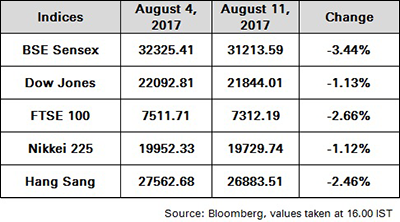

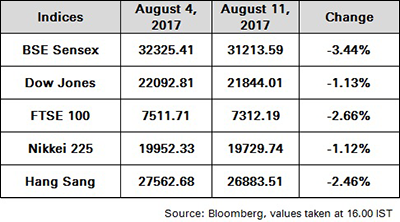

| Indian equities started in the red and fell to a one-month low during the week. Shares of refinery companies ended higher helped by fall in global crude oil prices and also with the inclusion of these companies in the new exchange traded fund Bharat-22 launched by the government on last Friday. |

| A mild risk off sentiment hit investors after India’s security regulator (SEBI) issued a directive to stock exchanges to take action against shell companies. Mid cap shares were the worst hit on fears that margin funding will decline due to SEBI’s latest directive. |

| Global equity markets were hit by a risk off sentiment after tensions ratchet up in the Korean peninsula, with top officials from North Korea and US exchanging sharp diatribes. |

|

| During the week Sensex lost 3.44% to close at 31213.59 while Nifty declined 3.66% to close at 9710.80 |

|

|

|

|

|

|

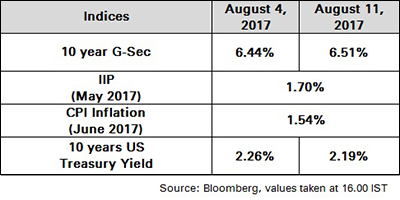

| Indian government bonds started the week lower. Government bonds remained down because appetite for dated securities was subdued ahead of the heavy supply of central and state government bonds this week. Results of the statedevelopment loan auctions were in line with market expectations. |

| Further, investors refrained from taking fresh positions ahead of next week’s releases, namely July inflation print and minutes of the RBI’s August policy meet. The heavy supply of gilts put bond prices under pressure. With no prospects of rate cuts by RBI in the immediate future, gilts continue to face headwinds. |

|

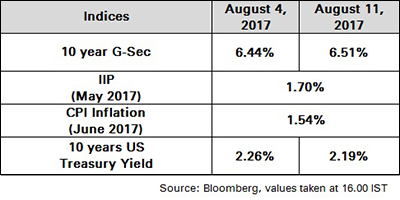

The 10Y benchmark yield ended at 6.51% as compared to previous week’s close of 6.44%.

|

|

|

|

|

|

|

|

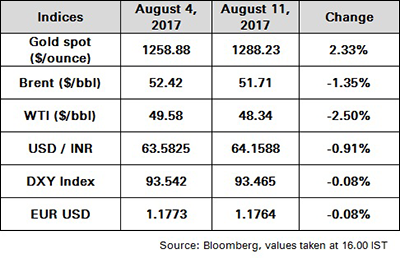

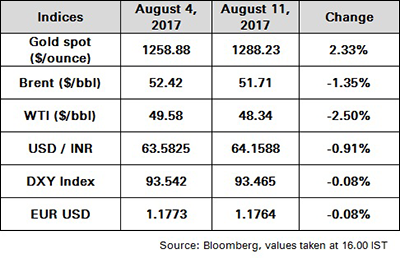

| Oil started week lower by more than 1%. Crude prices struggled to rally even amidst positive US oil rig data which pulled its count by 1 to 765, as reported by Baker Hughes. The advance in prices was halted as rising global supply from OPEC producers eroded optimism of output curbs and better compliance. |

| Saudi Arabia announced cutting crude sales to Asian buyers as part of its pledge to reduce exports and curb the oil glut. Oil gained towards the end of the week buoyed by OPEC’s forecast of higher demand for crude oil production in 2018 due to rising global consumption and slower supply growth from rivals. The cartel puts July production at 32.87 mn barrels, up 173K barrels from previous months. The increase was largely driven by production from Libya, Nigeria and Saudi Arabia, taking the overall compliance down to 86%. |

|

|

|

|

|

|

| Gold stated week marginally lower. The yellow metal stayed near its 2 week lows on the back of favourable US employment data last week. The commodity regained momentum as the greenback slumped during mid-week. |

| The yellow metal pushed ahead to rally as geopolitical tensions escalated on North Korea’s threat to fire missiles at Guam, a US territory. Political tensions between the two nations should drive gold upwards. The commodities movement continue to be driven by political tensions ahead of the US inflation data. |

|

|

|

|

|

|

|

|

| Rupee: Stronger now, weaker later |

| Indian Rupee has been one of the better performing EM currencies in 2017. This performance is supported by the benign global financial market environment and improved political landscape domestically. The reform push has received a major thrust with the implementation of the long awaited GST bill. We are revising our Rupee outlook to 64.50 for the current fiscal year with a variation of +/- 2%. This level is stronger as compared to the previous forecast of 65.50 by March 2018, but weaker from the current levels of 63.75. In this note, we highlight the key factors that are expected to drive Rupee trajectory from the short/medium term perspective. |

|

|

| Key factors that have led to the Rupee strength |

| • |

Dollar has underperformed vis-à-vis expectation amid lack of reform push by the political leadership |

| • |

Chinese Yuan volatility has subsided amid increase in FX reserves |

| • |

Strong capital flows in the domestic economy amid benign global environment. |

|

|

| Key factors that will drive Rupee trajectory going forward |

| • |

Major global central banks have indicated their intention to move away from easing stance. This has the potential to tighten liquidity condition globally |

| • |

US debt ceiling limit another source of uncertainty from the financial market perspective |

| • |

On the domestic front, though external sector outlook remain robust, current account is worsening on the margin |

| • |

Risk to portfolio flows remains amid lack of utilisation limit in the G-sec and corporate debt market. Stretched valuation in the equity segment limits the scope of significant equities related flows |

| • |

RBI to continue with the FX intervention strategy. |

|

|

| Conclusion: Revising the Rupee outlook |

| With all the factors under consideration, we are revising our Rupee outlook to 64.50 for the current fiscal year with a variation of +/- 2%. The depreciation bias in the Dollar index over the last few months amid rising political uncertainty domestically and major central banks moving away from the easing stance have been the key driver for the change in view. Reduced Yuan volatility amid increase in FX reserves in China has also been supportive for Rupee trajectory. External shocks led by the Fed unwinding or any triggers from the ECB continue to remain the key risks to the outlook. |

|

|

|

|

|

|

|

| |

| Sensex |

|

|

|

During the week Sensex lost 3.44% to close at 31213.59 while Nifty declined 3.66% to close at 9710.80

|

|

|

|

| |

| Bond Yields |

|

|

|

The 10Y benchmark yield ended at 6.51% as compared to previous week’s close of 6.44%.

|

|

|

|

|

|

|

|

Source: ICICI Bank Research, Bloomberg and CRISIL.

Disclaimer:

The information set out herein has been prepared by ICICI Bank in good

faith and from sources deemed reliable. ICICI Bank does not provide any

assurance as regards the accuracy of such information. ICICI Bank does

not accept any responsibility for any errors whether caused by

negligence or otherwise or for any direct or indirect loss / claim/

damage caused to any person, arising out of or in relation to the use of

information communicated herein.

If you do not wish to receive further marketing e-mails, to unsubscribe,click here. |