|

|

| Listen to the summary via VoiceAssist |

|

|

|

|

|

|

|

|

| • |

India's fiscal deficit touched Rs. 3.73 lakh cr ($57.69 bn) during April-May period or 68.3% of the budgeted target for the current fiscal year that ends in March; the fiscal deficit was 42.9% of the full-year target during the same period a year ago |

| • |

India's growth of eight core sectors slowed to 3.6% in May due to fall in output of coal, fertiliser and steel; growth was 5.2% in May last year and 2.8% in April 2017 |

| • |

India's forex reserves rose by $576.4 mn to touch a new life-time high of $382.53 bn in the week to June 23 |

| • |

Reserve Bank of India (RBI) increases the FPI investment limit in government securities by 4.7% to Rs. 2.42 lakh cr for July-September quarter; also says that future increases in the limits will be allocated in the ratio of 75% for long term category of FPIs and 25% for general category |

| • |

RBI is expected to introduce Rs. 200 notes in the coming months to ease pressure on lower-denomination currencies that are in short supply |

| • |

IMF said India's growth outlook has improved as the impact of last year's demonetisation exercise seems to be fading |

| • |

Government allows retailers with unsold pre-GST stocks to stick new prices on them for sales, taking into account the post-GST changes |

| • |

The Centre's net direct tax collections grew 14.8% in April-June 2017 at Rs 1.42 lakh cr; this collection level represents 14.5% of the total budget estimate of direct taxes for 2017-18 (Rs. 9.8 lakh cr) |

| • |

RBI said customers will not suffer any loss if unauthorised electronic banking transactions are reported within three days and the amount involved will be credited in the accounts concerned within 10 days. |

|

|

|

|

|

|

|

|

| • |

US personal income climbed by 0.4% in May after rising by a downwardly revised 0.3% in April; consumer spending rose 0.1% in May after climbing 0.4% in April |

| • |

US auto sales for June came in at a seasonally adjusted annualised rate of 16.51 mn units, 2% lower than the June 2016 figure |

| • |

China Caixin services PMI came in at 51.6 in June, down from May's 52.8, while composite PMI fell to 51.1 in June, from 51.5 in May |

| • |

US Federal Reserve's meeting minutes shows that several members were in favour of starting the reduction of its $4.5 trillion balance sheet within a couple of months. |

| • |

According to ADP, US private sector payrolls increased by 158,000 jobs in June, stepping down from the 230,000 positions created in May. |

| • |

US trade deficit narrowed to $46.5 bn in May from $47.6 bn in April |

| • |

Eurozone annual inflation is expected to be 1.3% in June, down from 1.4% in May |

| • |

US services PMI registered 54.2 in June, up from 53.6 in May; the composite PMI rose to 53.9 in June, up from 53.6 in the previous month. |

|

|

|

|

|

|

|

|

|

Majority of the logistics companies gained as the GST augurs well for these companies, which have to struggle with a different tax regime in each state

Real estate companies were among the prominent laggards as the government's revision of GST rates for construction sector added to apprehension

Metal stocks had rallied tracking rise in global metal prices

Global equities were jittery on renewed concerns in the Korean peninsula after North Korea said that it has successfully tested an inter-continental ballistic missile capable of striking the US

Public sector lenders soared after SBI (up 2.2%) had cut its interest rate on short-term fixed deposits by 15 bps to the lowest level in seven years

Indian benchmark indices ended higher on Thursday on easing concerns over major disruption due to the implementation of the Goods and Services Tax

|

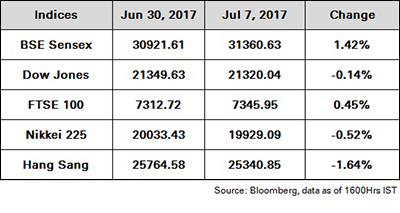

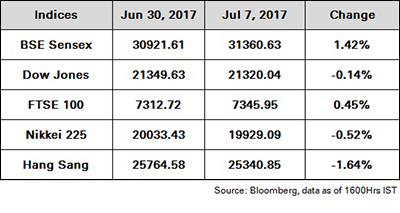

During the week Sensex gained 1.42% to close at 31360.63 while Nifty inclined 1.50% to close at 9665.8

|

|

|

|

|

|

|

|

|

| • |

Government bonds ended off highs on Thursday after the RBI decided not to sell the 7.28% 2019 gilt at the open market bond auction. |

| • |

Bonds opened the session on a strong note tracking a sharp overnight fall in global crude oil prices. |

| • |

Strong demand at the auction of unutilised investment limits in government bonds for foreign institutional investors on July 5 buoyed market sentiment |

| • |

The central bank held three reverse repo auctions of 28 day, 14 day, and 7 day durations for a total notified Rs. 70,000 cr |

| • |

An increase in crude oil prices and US benchmark treasury yields had put bond prices under pressure intraday |

| • |

The interbank call money rate ended at 6.05% on Thursday, steady compared to Wednesday, as surplus liquidity conditions persisted |

|

The 10Y benchmark yield ended at 6.54% vs. previous week’s close of 6.51%

|

|

|

|

|

|

|

|

|

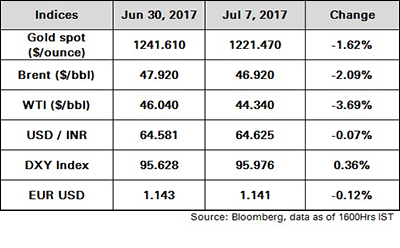

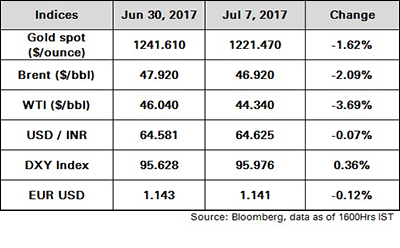

US crude oil inventories fell 6.3 mn barrels to 502.9 mn barrels for the week ended June 30

Crude oil prices had fallen on news that Russia has ruled out any proposals to deepen the global production cuts and reports of higher monthly exports from OPEC

Indian Oil Corp issued its first ever tender to buy high-sulphur, or sour, crude from North America as it seeks to diversify imports

Crude oil prices had risen on the NYMEX following a decline in the number of active US oil rigs.

|

|

|

|

|

|

|

|

Gold held steady as FOMC minutes pointed to a divergence in views on inflation trajectory among Fed policy makers. But FOMC minutes also reminded investors of a potential rate hike this year.

Increased geopolitical uncertainty helped the metal prices as North Korea successfully test fired an intercontinental ballistic missile taking it closer to a device capable of hitting continental US. Dollar gained marginally but could not halt the rally in gold prices.

The World Gold Council (WGC) says a hike in taxes on gold sales in India could pressure short-term demand for the yellow metal in the country.

|

|

|

|

|

|

|

|

Strength in domestic equities lent support to the local unit

For most of the session, importers' purchases of the greenback and strength in the dollar index weighed on the rupee.

Investor risk appetite was weighed down intraday by reports of geopolitical tension between China and India

The rupee was put under pressure intraday as North Korea’s announcement that it had test-fired an intercontinental ballistic missile weighed on global risk sentiment.

|

|

|

|

|

|

|

|

|

| |

| Sensex |

|

|

|

|

During the week Sensex gained 1.42% to close at 31360.63 while Nifty inclined 1.50% to close at 9665.8

|

|

|

|

| |

| Bond Yields |

|

|

|

|

The 10Y benchmark yield ended at 6.54% vs. previous week’s close of 6.51%%

|

|

|

|

|

|

|

|

Source: ICICI Bank Research, Bloomberg and CRISIL.

Disclaimer:

The information set out herein has been prepared by ICICI Bank in good

faith and from sources deemed reliable. ICICI Bank does not provide any

assurance as regards the accuracy of such information. ICICI Bank does

not accept any responsibility for any errors whether caused by

negligence or otherwise or for any direct or indirect loss / claim/

damage caused to any person, arising out of or in relation to the use of

information communicated herein.

If you do not wish to receive further marketing e-mails, to unsubscribe,click here. |