|

|

| Listen to the summary via VoiceAssist |

|

|

|

|

|

|

|

| • |

The RBI Monetary Policy Committee (MPC) cut the Repo rate by 25 bps and changed the stance to accommodative from neutral with a unanimous 6-0 vote. Given the change in stance, benign inflation trajectory and growing growth concerns, a rate cut in August seems on the table at the moment. |

| • |

India Gross Domestic Product (GDP) growth dipped to a 20-quarter low of 5.8% YoY in Q4 FY2019, while Gross Value Added (GVA) growth also plunged to 5.7% YoY. Dismal industrial growth coupled with a contraction in agriculture weighed on value addition in the January-March quarter. |

| • |

On an annual basis, GDP growth for FY2019 has been revised lower for the second time to a five-year low of 6.8% YoY in the Provisional Estimate from 7.0% YoY estimated earlier. |

| • |

The Government has met the fiscal deficit target of 3.4% of GDP for FY2019, after cutting spending towards the end of the financial year as revenue fell short of estimates. |

| • |

The fiscal deficit at the end of April, the first month of FY2020, was 22.3% of the full year budgeted estimate, better than 24.3% a year earlier. |

| • |

Pre-monsoon rainfall in India was 24% deficient as compared to normal, with most of the subdivisions receiving deficient rainfall. However, reservoir levels are better than last year, although sharp regional variations are present. The rural economy is still showing signs of subdued sentiment and income growth. Going ahead, the Government’s support and an expected upturn in food prices could support, although monsoon distribution needs to be watched. |

|

|

|

|

|

|

|

| • |

President Mr Trump opened another potential front in his trade war on Friday, terminating India's designation as a beneficiary developing nation under the key Generalised System of Preference trade programme after determining that it has not assured the US that it will provide "equitable and reasonable access" to its markets. |

| • |

West Texas Intermediate (WTI) entered a bear market after tumbling as much as 5.4% and Brent briefly fell below USD 60/bbl for the first time since January as U.S. petroleum stockpiles jumped the most in almost 30 years as domestic output hit a record. |

| • |

The International Monetary Fund (IMF) trimmed its forecasts for economic growth in China, with growth expected at 6.2% this year and 6.0% in 2020. The IMF also said that taxing all trade between the US and China would cause some USD 455 billion in GDP to evaporate. |

| • |

The World Bank has retained its forecast of India's growth rate at 7.5% for the current financial year in its Global Economic Prospects report. |

|

|

|

|

|

|

|

| • |

Indian equities ended sharply lower and saw biggest one-day fall this year, dragged down by banks even after the RBI cut repo rate by 25 bps and changed policy stance to accommodative from neutral. No concrete decision was made in the RBI policy statement to tackle the liquidity crisis which dented the risk appetite. |

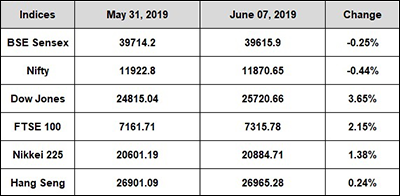

During the week Sensex lost 0.25% to close at 39615.9 while Nifty declined 0.44% to close at 11870.65

|

|

|

|

|

|

|

|

|

| • |

Indian bonds are trading lower today. The bonds pared some gains amid profit booking. Mood was upbeat on RBI's decision to cut the repo rate by 25 basis points and easing monetary policy stance. |

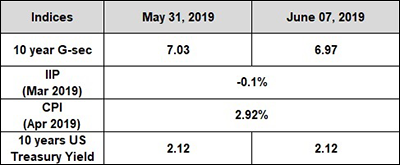

The 10Y benchmark yield ended at 6.95% as compared to the previous week’s close of 7.03%

|

|

|

|

|

|

|

|

|

| • |

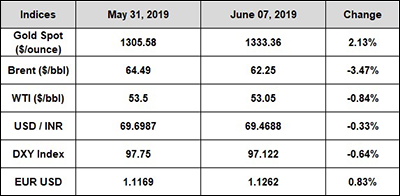

Prices fell to their lowest level since January as concerns over global growth slowdown hitting oil demand worked as a headwind. Trade war rhetoric between US and China continues to escalate. Prices were also weighed down by comments from Mr Igor Sechn, head of Rosneft, Russia's top state producer who said that Russia should pump oil at will and that he would seek compensation from the government if Organisation of the Petroleum Exporting Countries (OPEC) led cuts were extended in later half of this year. Brent and WTI are trading at USD 60.55/bbl and USD 52.75/bbl, respectively. |

|

|

|

|

|

|

|

| • |

The metal approached its highest level this year on increasing expectations of multiple rate cuts by the Federal Reserve. Persisting trade related uncertainties are also leading to safe havens flows into the metal. Gold currently trades at USD 1,335/ounce. |

|

|

|

|

|

|

|

|

| • |

The Indian Rupee ended lower, on dollar buys by Public Sector Unit (PSU) banks likely for importers. Some banks covered short dollar bets. Dollar sales by foreign banks and exporters supported the domestic currency. The USD/INR pair ended at 69.28 vs. the previous close of 69.26. |

|

|

|

|

|

|

|

| |

| Sensex |

|

|

|

During the week Sensex lost 0.25% to close at 39615.9 while Nifty declined 0.44% to close at 11870.65

|

|

|

|

| |

| Bond Yields |

|

|

|

The 10Y benchmark yield ended at 6.95% as compared to the previous week’s close of 7.03%

|

|

|

|

|

|

|

|

Source: ICICI Bank Research, Bloomberg and CRISIL.

Disclaimer:

The information set out herein has been prepared by ICICI Bank in good

faith and from sources deemed reliable. ICICI Bank does not provide any

assurance as regards the accuracy of such information. ICICI Bank does

not accept any responsibility for any errors whether caused by

negligence or otherwise or for any direct or indirect loss / claim/

damage caused to any person, arising out of or in relation to the use of

information communicated herein.

|