|

|

| Listen to the summary via VoiceAssist |

|

|

|

|

|

|

|

| • |

As widely expected the Monetary Policy Committee (MPC) kept rates unchanged and maintained the stance as accommodative

|

| • |

MPC revised its Q4 FY2020 through H1 FY2021 forecasts significantly upwards, with inflation only showing some respite in Q3 FY2021 at an expected 3.2%.. |

| • |

As widely expected the Monetary Policy Committee (MPC) kept rates unchanged and maintained the stance as accommodative

|

| • |

RBI’s FY2021 growth forecasts were also revised downwards by 100 bps, with expectations of growth recovering above 6% only in Q3 FY2021.

|

| • |

India's Purchasing Managers' Index (PMI) for the services sector rose to a seven-year high of 55.5 in January as new orders and output increased at the fastest pace in seven years. PMI manufacturing also rose to 55.3, its 8-year high in January. Hiring activity improved in January, with firms increasing employment at the quickest rate in close to seven-and-a-half years.

|

| • |

India’s Union Budget FY2021 pegged fiscal deficit to Gross Domestic Product (GDP) ratio at 3.5% for FY2021, while the same for FY2020 was expected to be 3.8%.

|

|

|

|

|

|

|

|

| • |

Deaths from the coronavirus outbreak climbed towards 500 and cases worldwide reached almost 25,000. Markets rallied after Chinese television reported possible progress in the hunt for a treatment. |

| • |

China said it would slash tariffs on USD 75 billion of U.S. imports in half as part of its efforts to implement a recently signed trade agreement with Washington..

|

| • |

Bank of China cut the 7-day Reverse Repo rate by 10 basis points to 2.4%. It added CNY 900 billion of funds. It also injected CNY 300 billion with 14-day contracts at 2.55%. The total is the largest single-day addition of its kind since 2004, amid attempts to support the economy from the fallout of the coronavirus.

|

| • |

The US President has been acquitted by the Senate in the impeachment trial.

|

| • |

The Reserve Bank of Australia maintained its official cash rate at a record low of 0.75%.

|

|

|

|

|

|

|

|

| • |

Indian equity markets ended higher boosted by state-owned banking stocks, as the RBI kept rates steady. |

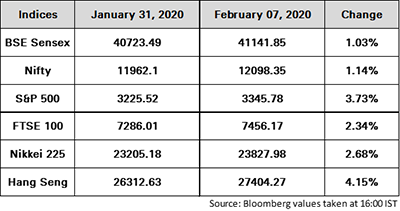

During the week Sensex gained 1.03% to close at 41141.85 while Nifty advanced 1.14% to close at 12098.35

|

|

|

|

|

|

|

|

|

| • |

Indian Government bonds ended steady, as market participants perceive comments by RBI as intent to keep liquidity at surplus for a prolonged period. RBI comments were seen as dovish on inflation-growth dynamics.

|

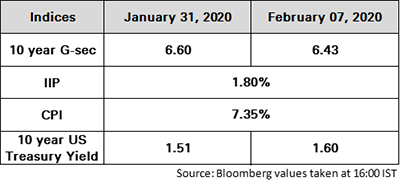

The 10Y benchmark yield ended at 6.43% as compared to the previous week’s close of 6.60%

|

|

|

|

|

|

|

|

|

| • |

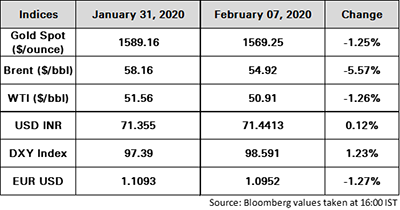

Oil is trading weaker. Russia foreign minister said it backs a recommendation for Organisation of Petroleum Exporting Countries (OPEC) and other producers to deepen output cuts amid falling demand for crude as China battles the coronavirus epidemic that has hit global markets. |

|

|

|

|

|

|

|

| • |

Gold traded weaker as China’s central bank cut reverse repo rates and injected liquidity into markets to help support an economy hit by a coronavirus outbreak. Further, a firm Dollar is weighing on the gold prices. |

|

|

|

|

|

|

|

|

| • |

The Indian Rupee ended stronger against the dollar because global appetite for riskier assets improved following Chinese media reports that a research team at Zhejiang University has likely found a potent drug to treat people infected by coronavirus.

|

| • |

The greenback continued to gain some ground against the safe haven assets as risk sentiment improved.

|

| • |

Risk aversion remains prominent reflecting in the weakness in global equity markets supporting safe-haven currencies in the process.

|

| • |

The USD/JPY pair moved higher. Improved economic PMI survey in the UK pushed the GBP/USD pair higher.

|

|

|

|

|

|

|

|

| |

| Sensex |

|

|

|

During the week Sensex gained 1.03% to close at 41141.85 while Nifty advanced 1.14% to close at 12098.35

|

|

|

|

| |

| Bond Yields |

|

|

|

The 10Y benchmark yield ended at 6.43% as compared to the previous week’s close of 6.60%

|

|

|

|

|

|

|

|

Source: ICICI Bank Research, Private Banking Investment Strategy Team, Bloomberg and CRISIL.

Disclaimer:

The information set out herein has been prepared by ICICI Bank in good

faith and from sources deemed reliable. ICICI Bank does not provide any

assurance as regards the accuracy of such information. ICICI Bank does

not accept any responsibility for any errors whether caused by

negligence or otherwise or for any direct or indirect loss / claim/

damage caused to any person, arising out of or in relation to the use of

information communicated herein.

|