|

|

| Listen to the summary via VoiceAssist |

|

|

|

|

|

|

|

|

| • |

The RBI cut repo rate by 25 bps at its third bi-monthly monetary policy. Repo rate now stands at 6%, reverse repo at 5.75% and marginal standing facility at 6.25%. |

| • |

The central bank revised projected inflation trajectory upwards due to the following risks: |

| • |

Farm loan waivers: Fiscal slippages resulting from farm loan waivers could entail inflationary spillovers |

| • |

States’ pay commissions: The RBI forecasts that if States implement pay commissions similar to the Centre in FY 2018, inflation could rise by 100 bps over 18-24 months |

| • |

Recent surge in certain food items: Recent spike in certain food items could put pressure on inflation |

| • |

It retained GVA growth forecast for FY 2018 at 7.3% while emphasizing risks to growth forecasts are evenly balanced. |

|

|

|

| Other important developments during the week were: |

| • |

Pace of expansion of the India’s eight infrastructure sectors slowed to 0.4% YoY in June, a 19-month low, down from last month figure of 4.0% YoY, due to reduced output of cement, electricity and coal |

| • |

India Nikkei manufacturing purchasing managers' index (PMI) fell to 47.9 in July from 50.9 in June |

| • |

India's fiscal deficit touched Rs 4.42 lakh cr ($68.88 bn) during April-June period or 80.8% of the budgeted target for the current fiscal year that ends in March; the fiscal deficit was 61.1% of the full-year target during the same period a year ago |

| • |

SBI introduces a two-tier interest rate structure on savings bank deposits; with effect from July 2017, a savings bank balance of over Rs 1 cr will earn an interest rate of 4% per annum (p.a.), while the ones with Rs. 1 cr or less will earn an interest rate of 3.5% p.a. |

| • |

Government orders state-run oil companies to raise subsidised cooking gas (LPG) prices by Rs 4 per cylinder every month to eliminate all the subsidies by March next year |

| • |

India's foreign exchange reserves touched a new record high of $391.33 bn after it rose by $2.27 bn in the week to July 21. |

|

|

|

|

|

|

|

|

| • |

Eurozone economic confidence nudged up 0.1 points to 111.2 in July - its best level since before the financial crisis hit in 2007 |

| • |

Euro zone seasonally-adjusted unemployment rate was 9.1% in June, down from 9.2% in May and down from 10.1% in June 2016 |

| • |

The Eurozone economy expanded 2.1% in Q2 2017 compared to 1.9% in Q1 2017 |

| • |

Bank of England held the benchmark rate at 0.25%, maintaining status quo. MPC’ 6-2 decision was in line with market expectations |

| • |

China's official Purchasing Managers' Index (PMI) came in at 51.4 in July, compared with 51.7 in May, while non-manufacturing PMI fell to 54.5 in June from 54.9 in June. |

|

|

|

|

|

|

|

|

|

IRDAI directs ICICI Prudential Life Insurance to take over Sahara India Life Insurance Company

Shares of automobile makers gained due to higher-than-expected sales data for July

Indian equities ended lower, as bank stocks witnessed a sell-off post RBI’s policy. With the RBI maintaining its neutral stance and flagging other upside risks to inflation, rate sensitive sectors such as automobile, reality and other non-banking financial sectors also faced losses

Shares related to energy sector saw gains following higher than expected earnings reports from energy majors.

|

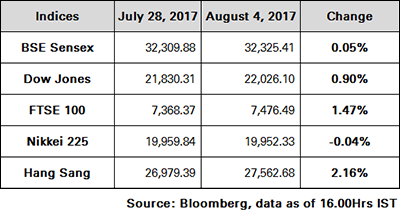

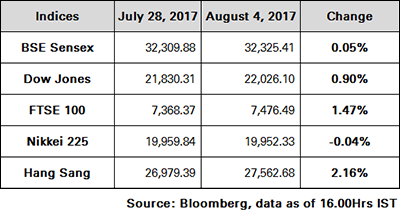

During the week, Sensex gained 0.05% to close at 32,325.41 while Nifty advanced 0.52% to close at 10,066.40

|

|

|

|

|

|

|

|

|

| • |

Indian government bonds rallied sharply higher after rate cut by the RBI. However, the neutral stance given by the RBI may limit the rally. Also the availability of INR 150 bn fresh government bonds on will weigh on prices |

| • |

RBI Deputy Governor Viral Acharya’s comments on draining out excess liquidity weighed on the bonds |

| • |

RBI withdrew liquidity to the tune of INR 2.95 tn (net) under LAF (including fixed and variable rate repos and reverse repos), as of August 1. It injected INR 5 bn and INR 16.53 bn under Marginal Standing Facility and Special Refinance Facility respectively. |

|

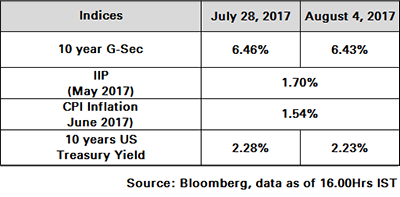

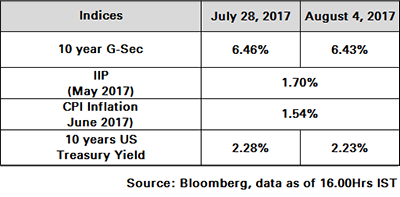

The 10Y benchmark yield ended at 6.43% Vs previous week’s close of 6.46%.

|

|

|

|

|

|

|

|

|

| • |

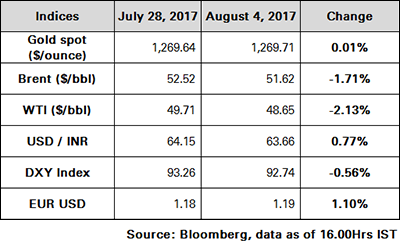

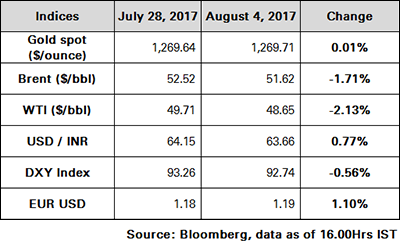

Oil bulls show signs as there are expectations of further declines in the US stockpiles from the EIA data to be released on Wednesday. Market confidence also grows, moving into the second half of the year, signaling a stronger demand |

| • |

EIA’s weekly report showed that US crude inventories declined by 1.5 mn barrels last week. Further, gasoline saw significant demand, with inventories declining by ~9.84 mn barrels adding to the bullish sentiment. However, the gains proved short-lived as media reports indicated that OPEC supplies increased in July to its highest level in 2017 despite production cuts |

| • |

The possibility of US sanctions against Venezuela would support the rally. Slight pessimism was casted by Baker Hughes data which reported an increase in oil rig count by 2 pushing the total to 766 as of last week. |

|

|

|

|

|

|

|

|

| • |

After the impressive rally in the past two weeks, gold started on a flat note this week. |

| • |

Markets are awaiting US nonfarm payrolls data which will give further direction to the metal. |

| • |

The political crisis in Washington has had limited effect on the metal so far, nevertheless, it needs to be followed closely.

|

|

|

|

|

|

|

|

| • |

The Dollar index has declined by ~2.9% over the month of July,as tepid data prints and political turmoil in Washington, as well as a dovish-perceived Fed and a bullish Euro kept the index under pressure. In the latestdevelopments, President Trump dismissed Communications Director, Mr. Anthony Scaramucci, after only ten days of service, purportedly on the request of his newChief of Staff, Mr. John Kelly |

| • |

INR is currently trading at its strongest level since July 2015 |

| • |

With RBI’s MPC maintaining its neutral stance, Rupee saw substantial demand, as foreign banks sold off Dollars triggering stop-losses in early trade. Dollar purchases by public sector banks capped gains. |

|

|

|

|

|

|

| |

| Sensex |

|

|

|

|

During the week, Sensex gained 0.05% to close at 32,325.41 while Nifty advanced 0.52% to close at 10,066.40

|

|

|

|

| |

| Bond Yields |

|

|

|

|

The 10Y benchmark yield ended at 6.43% Vs previous week’s close of 6.46%.

|

|

|

|

|

|

|

|

Source: ICICI Bank Research, Bloomberg and CRISIL.

Disclaimer:

The information set out herein has been prepared by ICICI Bank in good

faith and from sources deemed reliable. ICICI Bank does not provide any

assurance as regards the accuracy of such information. ICICI Bank does

not accept any responsibility for any errors whether caused by

negligence or otherwise or for any direct or indirect loss / claim/

damage caused to any person, arising out of or in relation to the use of

information communicated herein.

If you do not wish to receive further marketing e-mails, to unsubscribe,click here. |

|